Altaroc Odyssey 2024 FPCI

Discover

Altaroc Odyssey 2024

Past performance and the rigorous selection of target funds are no guarantee of future performance.

The key points of

Vintage 2024

Discover the new Vintage Altaroc Odyssey 2025

The Altaroc Odyssey 2024 portfolio

260M already committed

to 4 global managers

This selection reflects a commitment to sector and geographic diversification, in line withAltaroc's long-term strategy, and favors managers with strong sector specialization and a proven track record.

To date, €260m has been invested in Vintage funds.

Private equity investments entail risks of capital loss and liquidity. Past performance is no guarantee of future results.

Vitruvian

Thoma Bravo

Summit Partners

Bridgepoint

20% of Vintage in

co-investment

An initial co-investment was made alongside Thoma Bravo in Qlik, a leading player in data analytics software. This strategy aims to strengthen portfolio selectivity by targeting resilient, high-growth companies in Altaroc's preferred sectors of expertise.

Investing in private equity involves risks of capital loss and liquidity. Past performance is no guarantee of future results.

In particular, these reports provide information on portfolio valuations, additions to and exits from the portfolio, and the latest news on the companies we support.

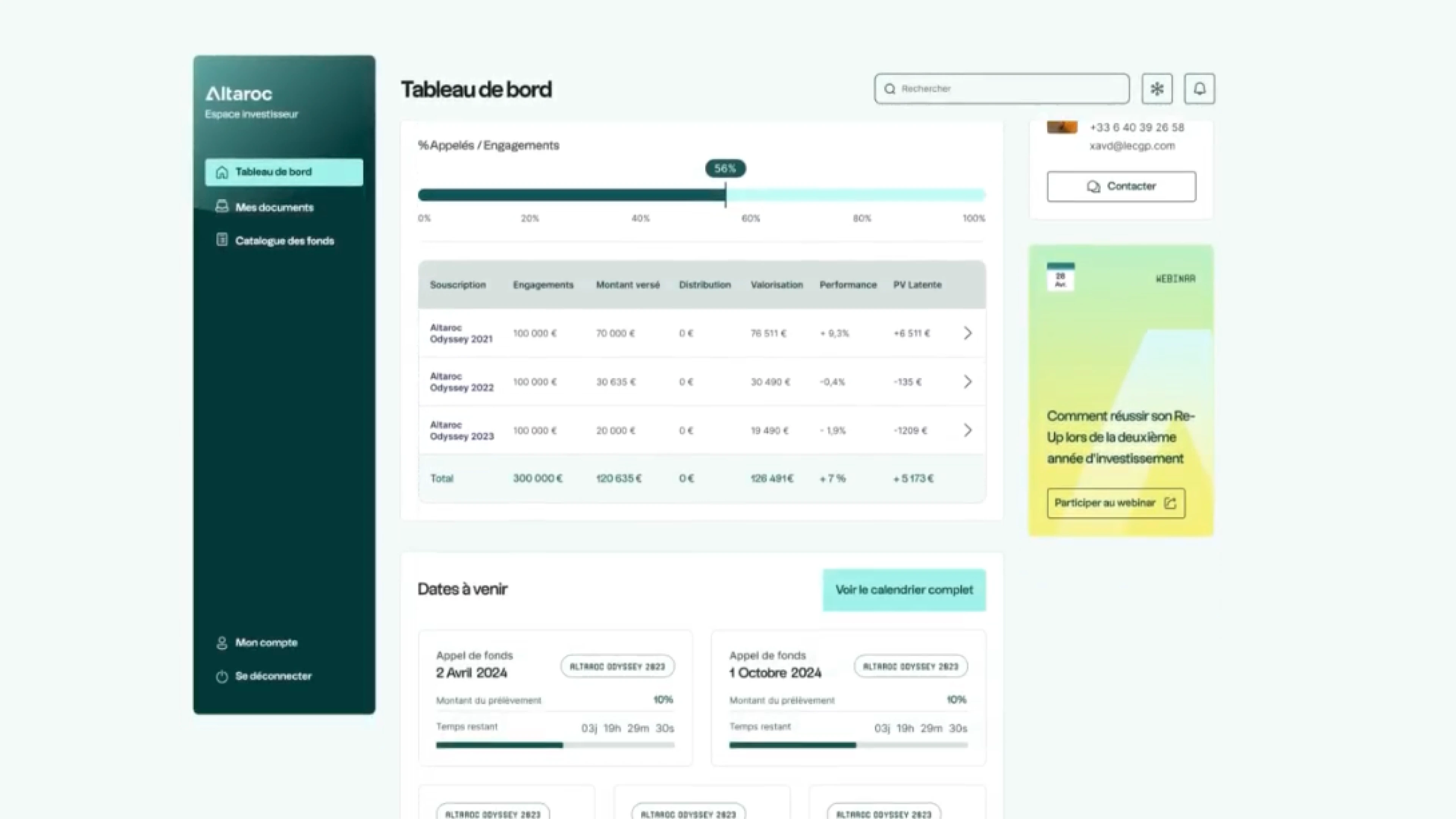

Simple, 100% digital subscription, a simplified fund call system, or tracking the life of the Vintage and the news of the underlying companies - everything has been thought out to offer a smooth, positive experience for both our investors and their advisors.

Investing in Altarocs vintage ranges enables customers to protect themselves against macroeconomic risk by investing in several Vintage.

Private equity investments entail risks of liquidity and capital loss.

Past performance is not a reliable guide to future returns.

The rate of deployment of the Vintage Odyssey range is explained by :

- the fact that fund selection is carried out within the first year of the Vintage's life, or, at the latest, within the following year. In contrast, most funds of funds, to ensure diversification by Vintage, take an average of 3 years to select their managers,

- the speed of deployment of the managers we select for our Odyssey portfolios,

- Altamir's sponsorship enables us to make an early commitment to the funds we select, as well as offering our subscribers access to well-invested Odyssey Vintage range.

Technology, Healthcare, B2B Services and Digital Consumers are the growth sectors that will drive the transformation of the economy in the years to come, and are characterised by their resilience. This is why Altaroc's investment team has developed particularly sharp expertise in these sectors.

The construction of Odyssey portfolios is based on the same criteria for all Vintage:

- a minimum size of €100m;

- 80% of capital invested in five to seven funds selected for their exceptional track record over time, to guarantee performance and diversification;

- 20% of capital allocated to co-investments alongside our managers, to boost performance;

- two main regions: Europe and North America, with exposure to Asia and the rest of the world via our global funds;

- two segments targeted for their higher profitability and lower volatility: Buyout and Growth Equity ;

- capital calls with fixed dates and amounts, to optimise investors' cash flow.

The 5 to 7 funds selected will be different for each Vintage in the Odyssey range.

.webp)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.webp)

.webp)

.jpeg)

.webp)