Invest in the real economy through Altaroc’s Private Equity solutions

Invest in private equity solutions using an institutional approach alongside an asset class pioneer

The institutional approach to private equity, accessible at last

Supporting long-term wealth building through Private Equity

Benefit from expert, committed support

An approach designed to integrate Private Equity into a robust and efficient asset allocation strategy.

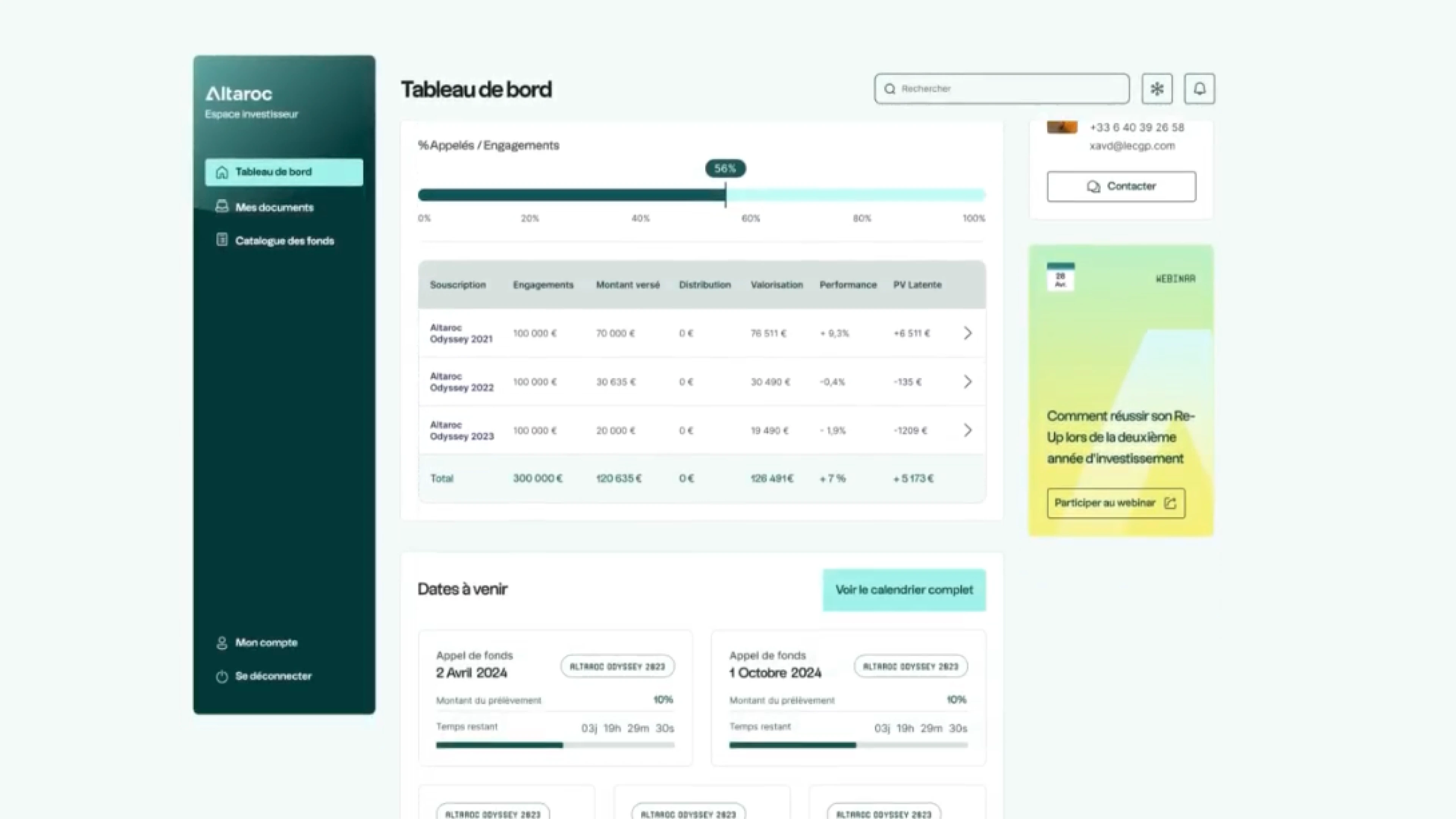

Simplifying private equity investment

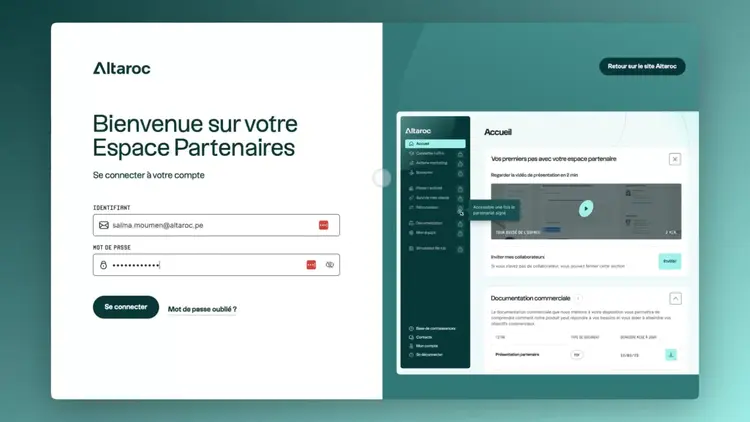

Secure spaces for partners and investors, dematerialized reporting and fluid investment paths: everything is designed to enhance efficiency, transparency and support for our partners and investors.

One of the best-performing asset classes in history

FCPR Discovery is a private equity product optimized for life insurance and PER. It combines controlled liquidity for policyholders and insurers with flexible underwriting and an immediate call for funds.

Investing in Private Equity from €100,000.

Every year, we build up a global, turnkey, high-performance and highly diversified Private Equity portfolio.

The Infinity range is dedicated to institutional investors and large estates.

A turnkey solution inspired by the best practices of pension funds, offering structured, diversified and institutional access to the asset class.

Investing in Private Equity, simply

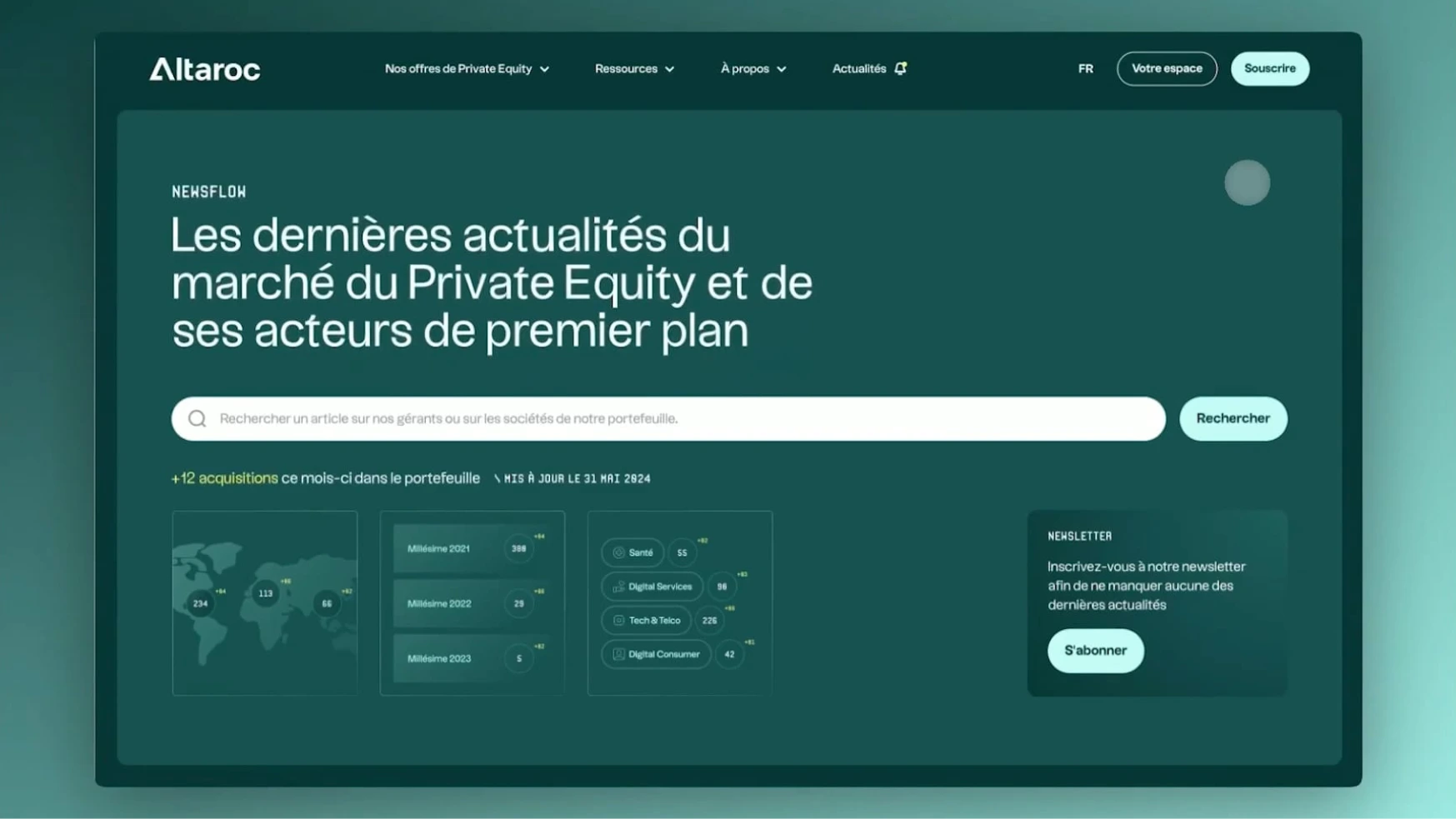

A complete ecosystem for customer relations

A system designed to integrate Private Equity into their offering and strengthen customer relationships over the long term.

Providing a transparent and educational digital experience

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.webp)

.webp)

.jpeg)

.webp)