Altalife 2023

Altalife 2023 closed on 12/31/2024.

Discover

Altalife 2023

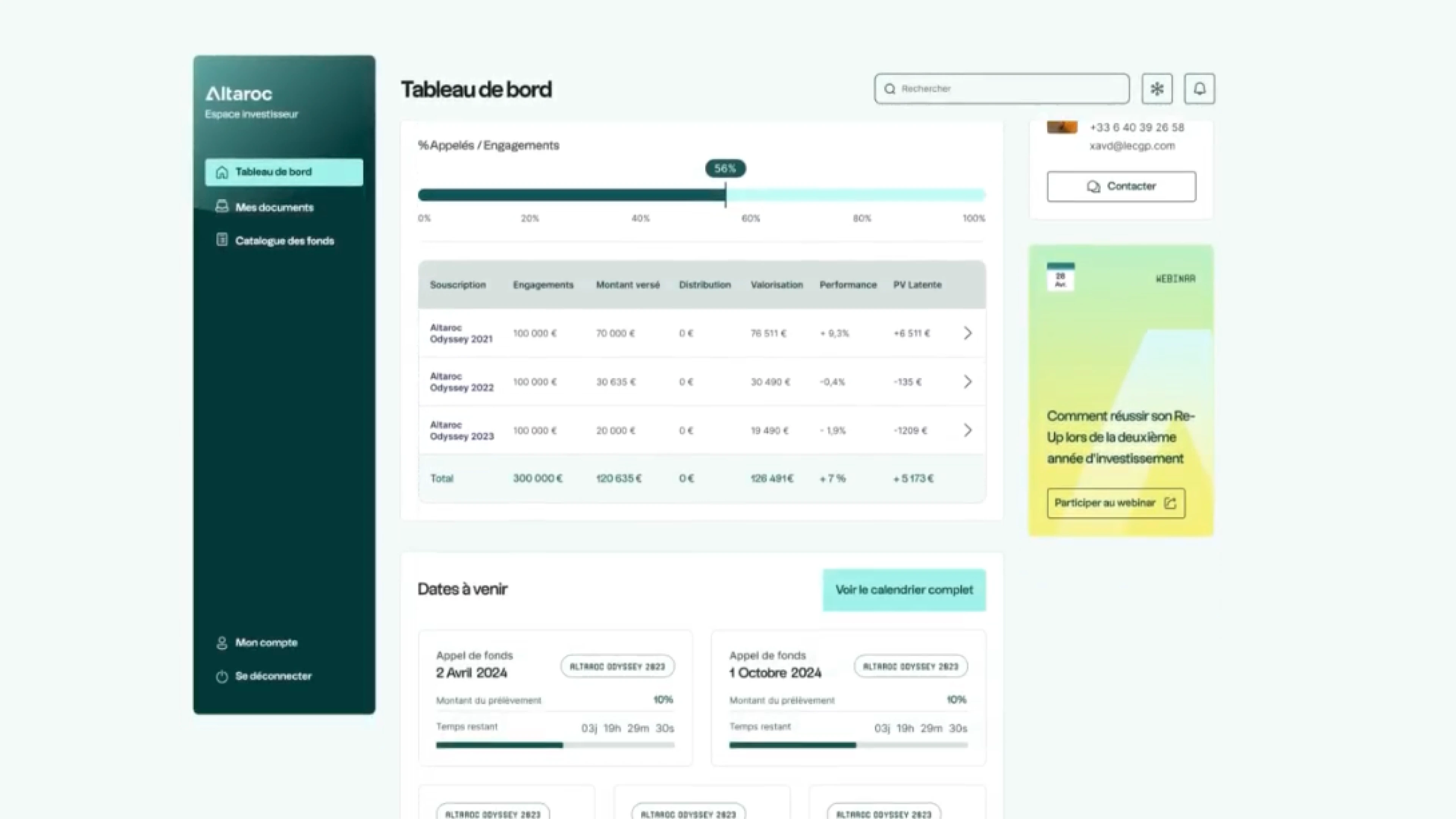

With Altalife 2023, Altaroc offers both geographic and sector diversification, with liquidity guaranteed by insurers.

Altalife 2023 key points

Private equity investments entail risks of liquidity and capital loss. To find out more about all the risks associated with private equity, visit our Private Equity Performance and Risks page.

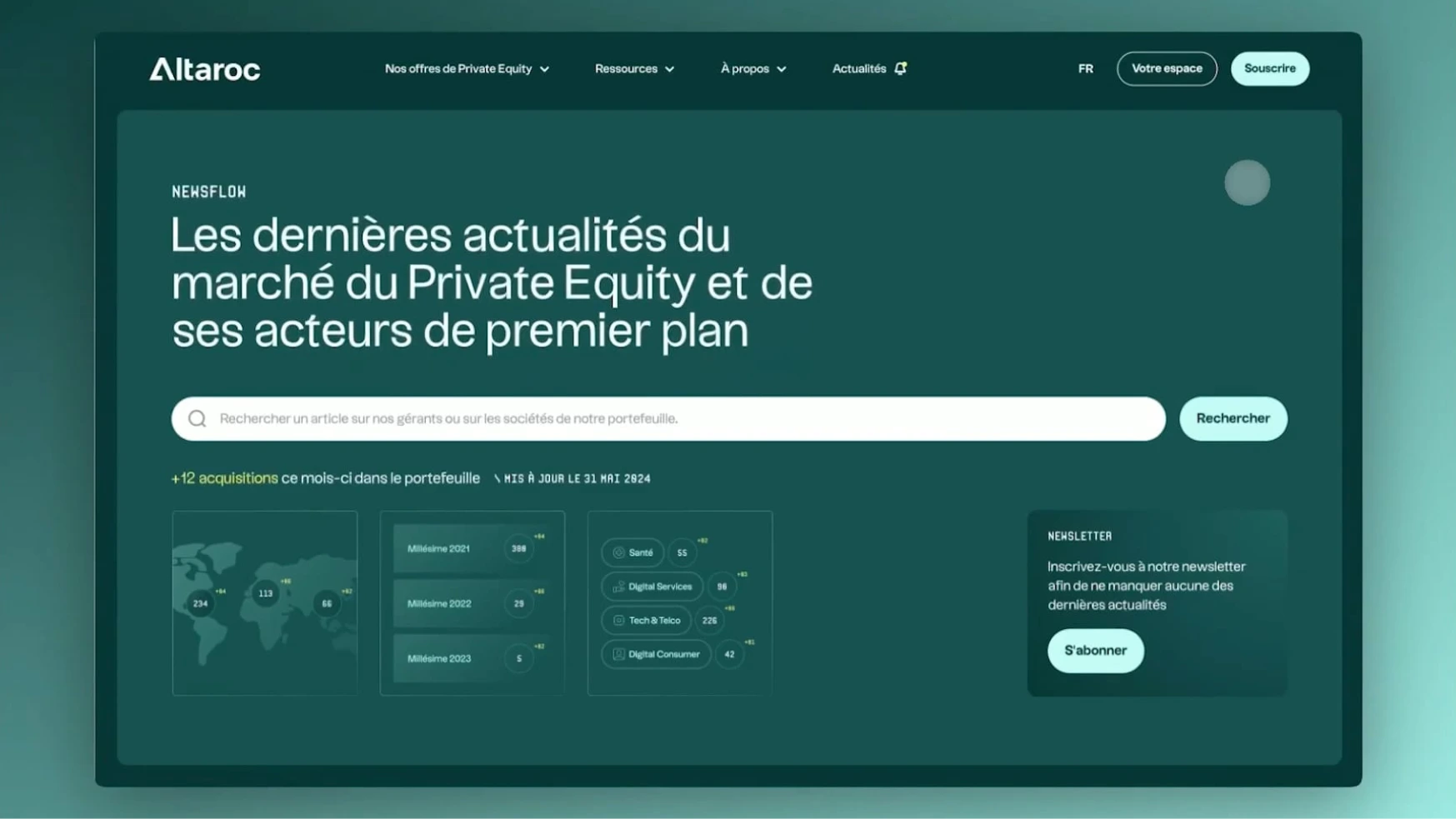

An offer distributed by a large number of insurers

Altalife 2023 portfolio

2 selected global funds

HgHg 4, a mid-market buyout fund managed by Hg, Europe's leading software fund manager.

Five Arrows Principal Investment IV ("FAPIIV"), a mid-market buyout fund managed by Five Arrows (Rothschild), which invests in the software, healthcare and business services sectors.

These two funds invest in Europe as well as in the United States, accounting for 20-25% of their funds.

Investing in private equity involves risks of capital loss and liquidity. Past performance is no guarantee of future results.

Five Arrows

Hg

4 co-investments made

Visma, an accounting, payroll and human resources software publisher with operations in Europe and Latin America

Diapason, a leading French publisher of cash flow and risk management software for large and mid-sized companies

Evoriel(ex Nexity ADB), a carve-out of the Nexity group's property administration business in France.

Howden, a leading insurance brokerage group, which operates across the entire value chain of the business (insurance, reinsurance, brokerage, consulting).

Private equity investment involves risks of capital loss and liquidity. Past performance is no guarantee of future results.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)

.webp)

.webp)

.jpeg)

.webp)