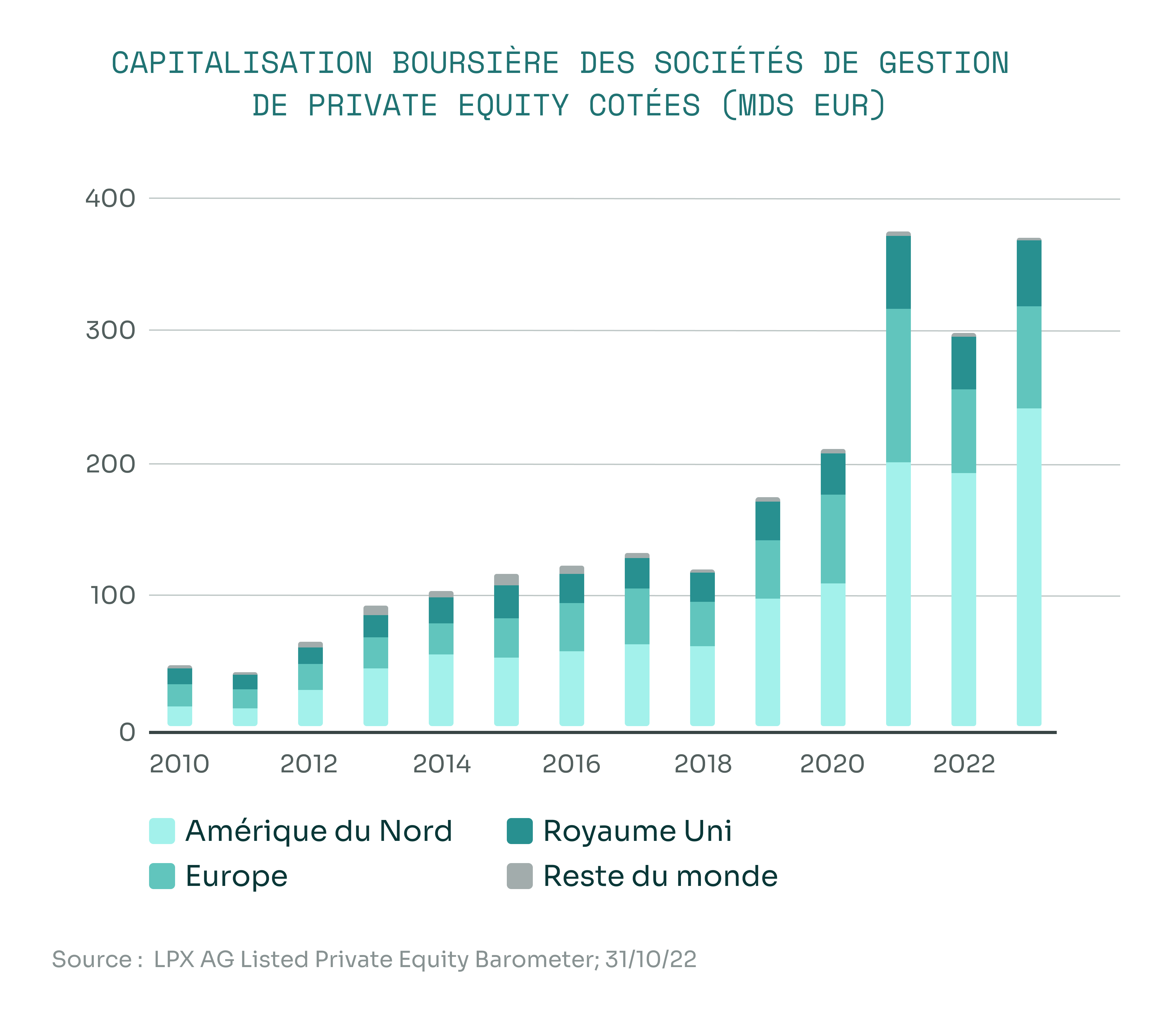

The figures speak for themselves. While the US private equity market is estimated to raise $460 billion in 2024 33, the European market has raised around $150 billion 34. Liberalism and prudence go head to head.

"The presence of pension funds, coupled with a higher cultural tolerance for risky investment and a better financial culture among participants, is the main difference that explains the greater domestic capacity for risky investment in the United States", explains Antoine Levy, French economist and assistant professor at UC Berkeley, in an exclusive interview with Altaroc.explains Antoine Levy, French economist and assistant professor at UC Berkeley, in an exclusive interview with Altaroc.

35

While the French pension system offers relative security, the opportunities for significantly increasing one's standard of living in retirement through personal investment remain limited. Indeed, alternative asset classes to listed markets are still too little known. In contrast, the United States offers the possibility of building higher pensions through private investment, but this is accompanied by increased risk-taking. These differences raise the question of pension financing: can the American model inspire Europe?

These contrasts are directly reflected in savings. While the majority of Americans turn to pension funds, property investments remain the preferred choice in France. This cultural preference for real estate has also limited the growth of financial products and alternative investments. And yet, over the past ten years, the average annual performance of real estate has been 4.7%, compared with 13.3% for private equity 36.

.png)

These disparities are also reflected in the scale of private equity investments, which are far more numerous among US pension funds. The attraction of private equity on the other side of the Atlantic is explained by its ability to respond to the pressure exerted by the moderate and volatile returns of traditional assets, while offering a long-term approach aligned with the needs of pension management. This trend has become even more pronounced since the 2008 financial crisis.

A U.S. boom driven by legislation and taxation

In the United States, the democratization of private equity has been facilitated by a more flexible regulatory environment. The Employee Retirement Income Security Act (ERISA), which governs retirement plans, has gradually evolved to facilitate access to this 37 asset class.

At the same time, tax reforms have helped to make investment in private assets more attractive. These include lower corporate taxes and changes in capital gains taxation. The Securities and Exchange Commission (SEC) in particular has contributed to this boom by easing certain restrictions, thereby facilitating pension funds' access to alternative investments.

Defined contribution plans, which dominate in the United States, have also played a decisive role. They offer greater freedom in the choice of investments, which has encouraged the integration of private equity into portfolios.

European funds remain cautious about private equity

Meanwhile, European and French players face a difficult road ahead. A stricter regulatory environment and a cultural aversion to risk are still holding back the growth of private equity. In an environment where short-term vision is still favored, assets such as government bonds and listed equities are still perceived as safer. And security is highly prized by European investors, particularly the French.

38

Above all, the liquidity and solvency requirements imposed by European regulations limit funds' ability to invest in less liquid assets, such as private equity. Legislation has thus discouraged funds from turning to these investments.

Promising prospects on the Old Continent

While US pension funds are increasing the share of private equity in their portfolios, European funds remain more cautious, despite growing interest in this asset class. This disparity raises questions about the evolution of European pension systems, which are still hampered by a number of obstacles.

Despite these contrasts, the outlook for private equity in Europe remains promising, marked by the desire to encourage alternative investments. This is evidenced by the emergence of a European framework for long-term capital investments, the ELTIF (European Long-Term Investment Funds). In France, the current environment is also benefiting from recent regulatory developments, such as the successive pension reforms that are paving the way for closer alignment with US practices.

Wider adoption of private equity in Europe still requires a change in investment culture and greater awareness on the part of both investors and fund managers. In this way, Europe will be able to take full advantage of the potential of private equity, while integrating the specific features of its retirement model and guaranteeing its stability.

33 https://www.mordorintelligence.com/fr/industry-reports/united-states-private-equity-mark

34 https://www.mordorintelligence.com/fr/industry-reports/europe-private-equity-market

35 https://www.amf-france.org/sites/institutionnel/files/private/2023-09/230911-private-equity-etat-des-lieux-et-vulnerabilites-l.-grillet-aubert-fr_0.pdf

36 https://www.franceinvest.eu/performance-nette-du-capital-investissement-francais/

37 See article: Private equity as a mirror of regulatory contrasts

38 https://www.herez.fr/wp-content/uploads/2023/09/UCPE-Epargnants-0509.pdf

.webp)