Is combining financial performance with respect for environmental, social and governance (ESG) criteria really a contradiction in terms? At a time when compliance needs are multiplying, and investors are no longer expecting just competitive returns, but also greater transparency in the integration of ESG criteria, this transition raises fundamental questions.

"The practice of integrating financially meaningful ESG measures into investment processes aims to strengthen risk management and can contribute to long-term financial returns. Therefore, we believe that ESG integration can help deliver improved risk-adjusted returns over the long term," explains J.P. Morgan in one of their memos to their investors.

ESG and private equity: constraint or opportunity?

According to a survey carried out by PwC, Private Equity Responsible Investment 2023 27, 78% of those questioned consider the ESG performance of a potential investment to be consistent with the search for returns. Seventy-one percent of respondents from 45 private equity companies include ESG criteria in their action plan immediately after an acquisition.

However, some players believe that the introduction of these criteria may lead to short-term compromises. "Financial investors are concerned that ESG criteria may restrict their investment options and impact their long-term returns. There is a tension between short-term market pressures and long-term ESG investment objectives", stresses Yifei Zhang, Professor at the University of Hong Kong.

Correlation between ESG criteria and financial performance

Whatever the case, between regulatory pressures and new expectations, the question is no longer whether pension funds should integrate ESG criteria, but how they should do so. A constraint that could ultimately be synonymous with opportunity.

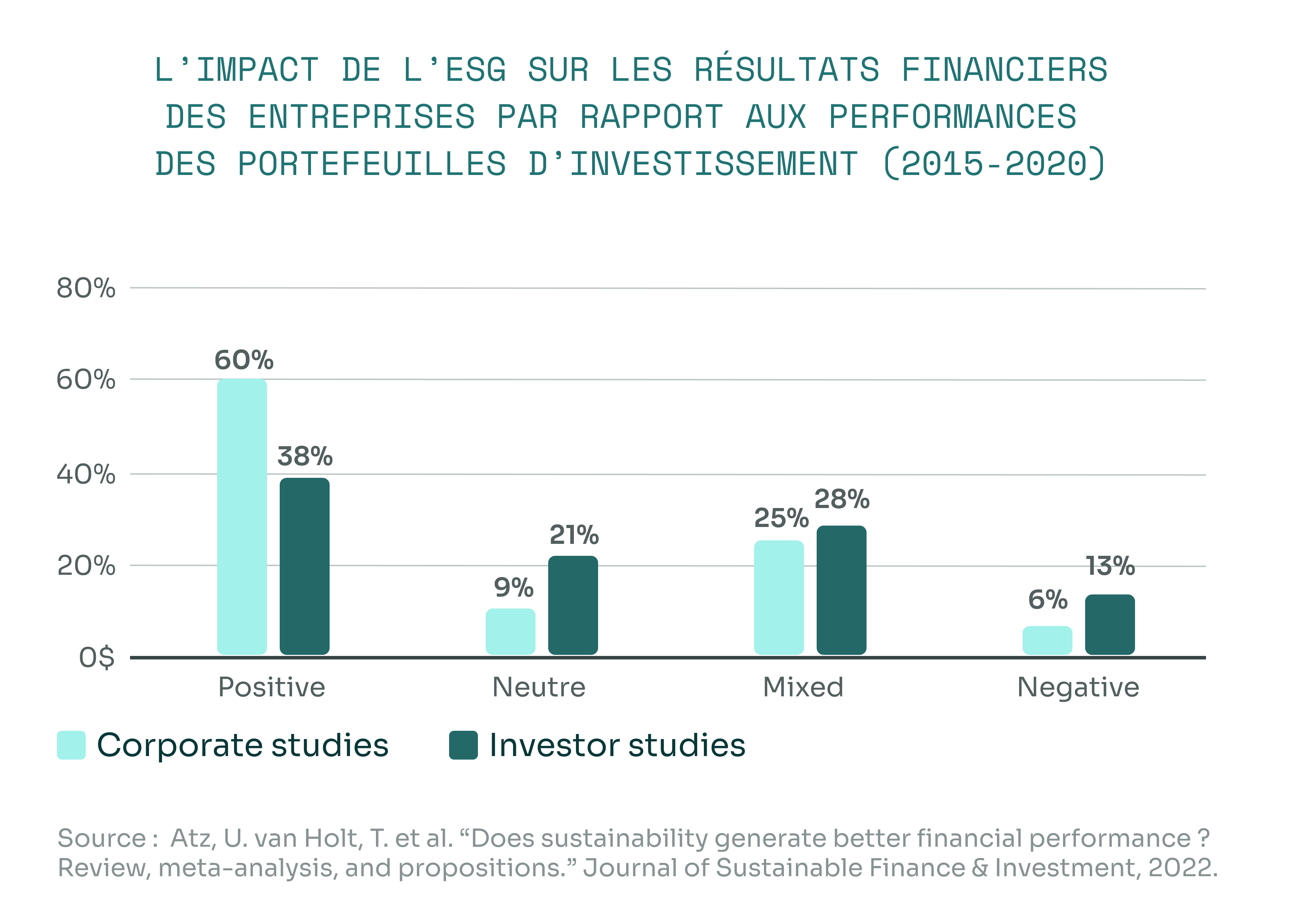

Investing in low-carbon companies and social initiatives can contribute to long-term stability. This is because they are better positioned to cope with environmental risks and regulatory pressures, as well as to meet consumer expectations. At least, that's what a meta-analysis of companies' ESG performance points out, based on a panel of 2,250 studies published between 1970 and 2014. In 62.6% of cases, ESG criteria are correlated with positive financial performance 28.

Among European large caps, ESG products returned 11.2% between January and August 2024, compared with 11% for traditional products. CSR can also help maximize returns by improving corporate image. ESG criteria are therefore not just a cost of compliance, but are also synonymous with profitability 29.

Nordic Capital Capital, an example of a successful CSR strategy

Many private equity managers have already demonstrated that ESG criteria can go hand in hand with outstanding financial performance. One of the most significant examples is Nordic Capital, the forerunner of private equity in the Nordic countries. The Swedish manager has successfully integrated ESG criteria into all its investment strategies.

This commitment is demonstrated by the highest score awarded by the Principles for Responsible Investment (PRI). Nordic Capital ranks among the top 10% of private equity firms worldwide in terms of ESG criteria integration. The firm, present in the Vintage FPCI Altaroc Odyssey 2021 and in the Vintage 2025 selection universe, was also recognized as "ESG Champion" at the Real Deals Private Equity Awards 30.

Nordic Capital assesses ESG criteria for each investment, enabling it to measure not only the environmental and social impact of each company, but also its governance. The manager has also defined greenhouse gas emission reduction targets in line with the Paris Agreement's 1.5°C trajectory, endorsed by the Science Based Targets (SBTi) 31 initiative. This proactive approach has enabled us to achieve above-market returns while meeting our corporate social responsibility targets.

More broadly, the acquisitions of Sesol, a leader in the installation of photovoltaic solar panels, AutoCirc, a company specializing in the re-use and recycling of automotive parts, and Sortera, a provider of waste management and treatment services, bear witness to this 32 commitment.

Responsible investment on the rise

ESG criteria also contribute to innovation. General Atlantic 's investment in 80 Acres Farms, a company featured in the Vintage FPCI Altraoc Odyssey 2021, is a case in point. Specializing in vertical and urban agriculture, the company produces fresh, healthy and sustainable food using robots and artificial intelligence. A new model that could soon become the norm.

The ethical and environmental challenges of integrating ESG criteria into private equity remain significant. Asset management companies and institutional investors, particularly those based in Europe, are coming under increasing pressure when it comes to CSR. As they seek to respond to these challenges, changing investor expectations and regulations are accelerating the trend.

However, best practices such as those of Nordic Capital Capital demonstrate that solid returns and social responsibility can coexist. Responsible investment also benefits from its long-term vision, which corresponds to the needs of some investors, notably for pensions. Between the integration of ESG criteria and the quest for profitability, funds are gradually finding their voice.

More information

Principles for Responsible Investment

Sponsored by the United Nations, the Principles for Responsible Investment (PRI) have over 5,000 signatories, including Altaroc, representing over 120 billion in assets under management. The initiative, created by institutional investors, aims to promote a sustainable and economically efficient global financial system that meets the challenges of ESG issues.

PRI is built around six pillars:

1. integrate ESG criteria into investment decision-making and analysis processes.

2. include ESG issues in shareholding policies and procedures.

3. ask portfolio companies for CSR transparency.

4. encourage adoption and implementation of the principles.

5. cooperate to improve the effectiveness and implementation of PRIs.

6. report on activities and progress.

Business ID card

Nordic Capital : the face of private equity in Northern Europe

Founded in 1989 in Stockholm, Nordic Capital is a pioneering private equity management company in the Nordic countries. The company invests in LBOs with a strong sector specialization, focusing 40% on healthcare, 40% on tech and payments, and 20% on financial services.

Nordic Capital manages over 30 billion euros in assets. The firm has over two hundred employees, including one hundred dedicated to investment.

27 https://www.pwc.fr/fr/publications/developpement-durable/capital-investissement-creer-de-la-valeur-avec-l-esg.html

28 https://www.tandfonline.com/doi/full/10.1080/20430795.2015.1118917 and https://www.robeco.com/fr-be/actualites/2024/01/l-esg-fait-il-plus-de-bruit-que-de-bien-pour-les-portefeuilles-d-investissement-

29 https://www.lemonde.fr/argent/article/2024/09 /14/investir-dans-les-fonds-durables-ca-recommence-a-redevenir-payant_6317228_1657007.html

30 https://www.nordiccapital.com/news-views/press-releases/nordic-capital-has-again-been-named-as-an-esg-champion-at-the-real-deals-private-equity-awards-2024

31 https://www.nordiccapital.com/our-impact/climate-action

32 https://panamericanfinance.com/insights/energy-transition/private-equity-investment-in-the-global-clean-economy-2023/lead-general-partners-profiles/nordic-capital/ and https://www.private-equitynews.com/news/nordic-capital-acquires-majority-share-in-sesol-a-green-tech-frontrunner-within-renewable-energy/