With the launch of the Altaroc fund range in October 2021, Altaroc Partners (formerly Amboise Partners) has established itself as the European leader in the democratization of Private Equity for individual investors. Altaroc 's value proposition is to market a new Vintage every year, invested in 5 to 7 managers from international teams with a proven track record. These top-quartile managers complement each other and offer a geographical spread to smooth out any potential problems linked to national economic conditions and geopolitical conflicts in particular.

The target is to have around 40% of Altaroc portfolios invested in the United States, a country which, as Virginie Robert, founder of Constance Associés, explains, has "the resilience, flexibility, capacity for innovation and keep moving characteristic of its industrial fabric".

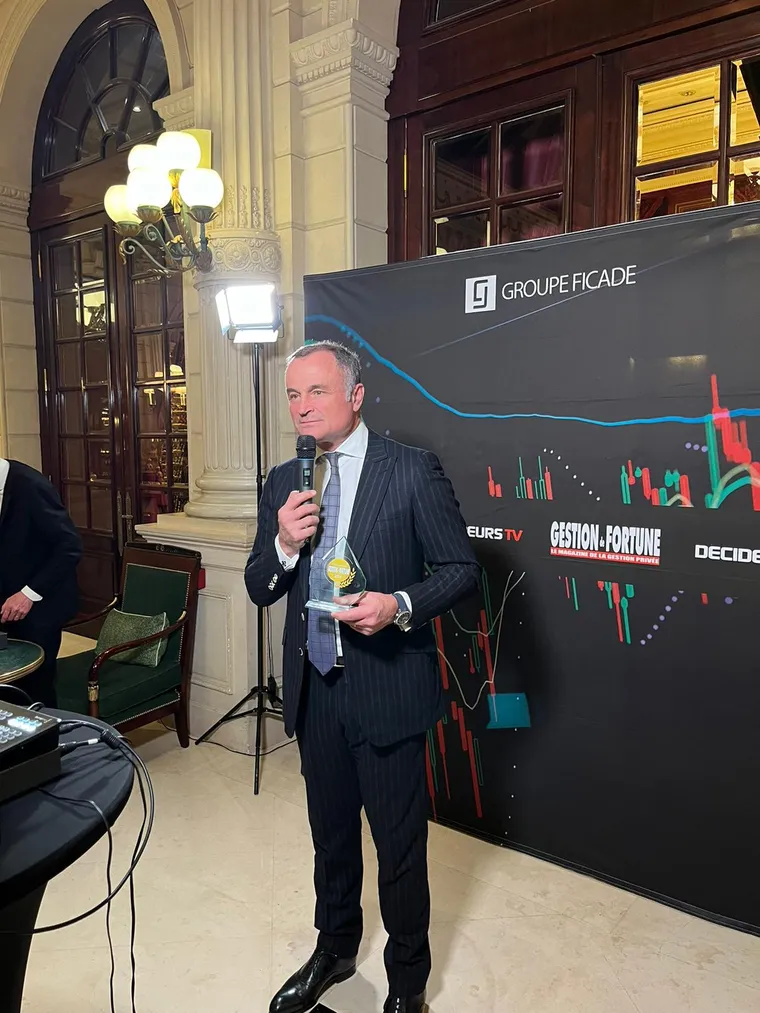

As Frédéric Stolar, Managing Partner ofAltaroc Partners, explains, investing in US funds is a logical and relevant choice because of the depth of the US market and the track-record, performance and specialization of its managers.

-

Advertising communication. Please refer to the AIF prospectus and key investor information documents before making any final investment decision. Private Equity involves a risk of capital loss and a liquidity risk. Past performance is no guarantee of future results.

.webp)

.webp)

.webp)

.webp)