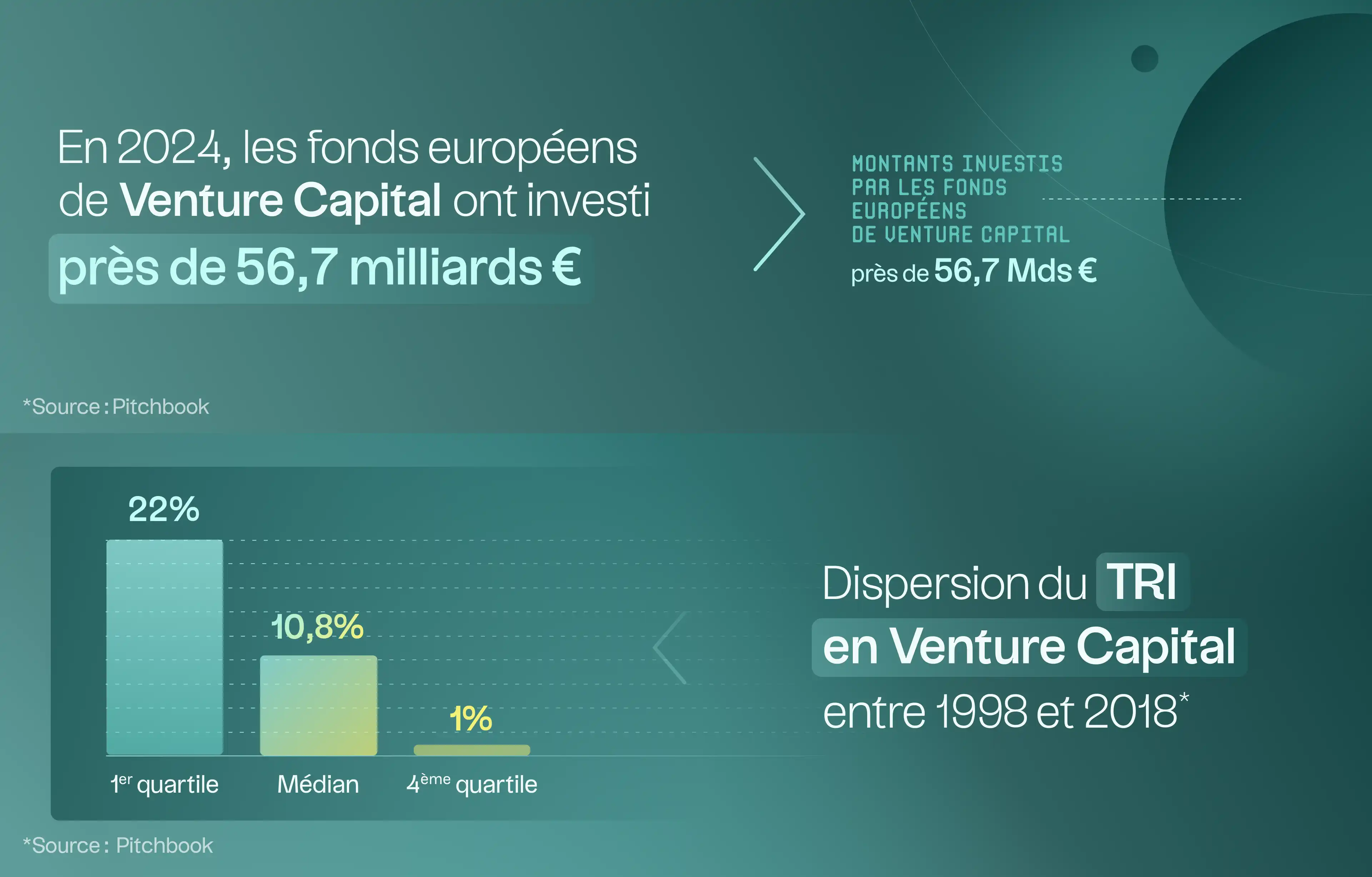

Venture capital allows you to bet on innovation

Venture capital is the gateway to Private Equity. It involves investments in start-ups or young innovative companies with high growth potential. At this stage, the targeted companies have generally not yet reached profitability, but they have innovative ideas and a promising addressable market.

Venture capital funds not only provide financing, but also strategic support to help these young companies structure their activities, recruit key talent and refine their offer. In return, investors take significant risks, because the failure rate of start-ups remains high. Successes can be spectacular, as demonstrated by the journeys of companies such as Spotify or AirBnB, initially financed by venture capital.

Fund performance often depends on one or two highly successful investments that can return 1 to 2 times the size of the fund on their own.

Growth Equity to Accelerate Growth

Growth Equity targets established companies whose product or service has proven its market adoption. Unlike venture capital, it is no longer about validating a technology or a business model, but about accelerating a commercial growth that is already underway. The companies targeted are generally profitable or on the verge of becoming profitable and have a solid positioning in their market.

At this stage, capital requirements remain high to finance ambitious projects, such as expansion into new markets, launching new products or strategic acquisitions. However, Growth Equity funds use little financial leverage (debt) to generate performance, as the priority is to reinvest profits in growth rather than distribute them.

Investors are often minority shareholders, leaving historical managers in control of the company while providing them with strategic support. Their added value is based on active support: structuring teams, improving business processes, geographical expansion and strengthening competitive positioning.

Example :

Consider the case of a technology company specializing in SaaS software, which has validated its business model and is experiencing strong growth in its domestic market. To accelerate its development, it wants to internationalize, strengthen its sales force and invest in new distribution channels. However, its self-financing capacities are limited compared to its ambitions.

A growth capital fund is stepping in here to help finance this phase of strong growth, by supporting geographic expansion, structuring the organization (recruitment, marketing, business development), and optimizing sales channels to reach a wider audience.

.webp)

Buyout to facilitate the transition

Capital transmission, also called LBO (leveraged buyout), consists of buying a mature company using debt to boost the performance of the transaction.

This strategy is often used to facilitate the transfer of a company from one owner to another, whether as part of a family succession, a change in management or an exit by an initial investor.

LBO funds seek to improve the profitability of acquired companies by optimizing their management, reducing costs and developing new growth opportunities. Unlike venture capital or development capital, LBO relies on companies that are already well established, with stable cash flows.

Example :

Let's take the case of a French family business specializing in the manufacture of electronic components. After several decades of management by the same family, the company is stable and mature, and the managers want to sell it to ensure its sustainability, due to the lack of internal succession.

The main objective of the LBO fund would be to optimize the management of the company, reduce operational costs and implement an external growth strategy, for example, by acquiring other companies to gain market share.

.webp)

A coherent value chain

Private Equity covers the entire life cycle of a company, from the early stages of innovation to transmission or exit on public markets. These different approaches allow investors to diversify their risks and maximize their returns by exposing themselves to different segments of the market.

For wealth management players and their private clients, understanding the different stages of Private Equity is essential to appreciate the opportunities and risks associated with this asset class. Each phase offers unique value creation potential, making Private Equity essential in a long-term diversification strategy.

.webp)

.png)

%2520(1).webp)